Future of the Forex Market

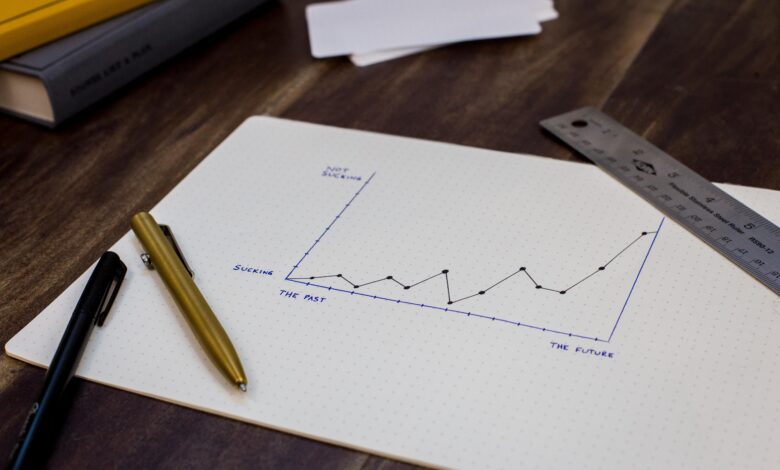

Future of the Forex Market has gained popularity as a widely accessible financial trading option, with many individuals considering it as a home business opportunity. The rise of online Forex trading in the early 2000s has significantly contributed to its growth. Looking ahead, the Forex market is expected to continue expanding and becoming even more popular.

While many people have heard about Forex, there are still numerous individuals who have limited knowledge and haven’t tried trading yet. The focus in the coming years will be on encouraging more people to engage in trading, even if it’s just through demo accounts. This increased popularity will lead to a surge in information related to analysis, trade ideas, systems, strategies, and expert advisors. Forex discussions will extend beyond dedicated forums and chatrooms and become common at unrelated gatherings and social events.

As the number of participants grows, market trends will become less distinctive, and reactions to global events like natural disasters, terrorism, war conflicts, and significant business news will be faster and more flexible. Market volatility will also increase due to the wider range of systems, strategies, and analytical reports employed by a larger pool of traders.

Stricter regulations will have an impact, attracting more conservative traders. However, unregulated Forex brokers will still remain popular as some traders prioritize inexpensive and easy trading over the protection of regulated environments.

Despite the availability of free alternatives, paid systems and strategies will continue to thrive. Effective marketing techniques will enable creators of paid “get rich with Forex” schemes to profit.

It’s important to note that Forex trading remains a high-risk speculative activity, offering both significant earning potential and a high probability of losses, regardless of the new developments in the market.

The future of the Forex market is influenced by several factors and trends that are shaping the financial industry as a whole. Here are some key aspects that may impact the future of the Forex market:

1. Technological Advancements:

Advancements in technology have significantly transformed the Forex market and will continue to do so in the future. These include:

a. Electronic Trading: The shift towards electronic trading platforms has made Forex trading more accessible and efficient. Traders can execute trades, access real-time market data, and utilize advanced trading tools from anywhere in the world.

b. Algorithmic Trading: Algorithmic trading, also known as automated or high-frequency trading, employs computer algorithms to execute trades at high speeds. This trend is likely to continue, with algorithms becoming more sophisticated and prevalent in the Forex market.

c. Artificial Intelligence (AI) and Machine Learning: AI and machine learning have the potential to revolutionize Forex trading. These technologies can analyze vast amounts of data, identify patterns, and make predictions, aiding traders in making more informed decisions.

d. Mobile Trading: The increasing use of smartphones and mobile apps has enabled traders to access the Forex market on the go. Mobile trading is expected to grow further, providing traders with greater flexibility and convenience.

2. Regulatory Changes:

Regulations play a crucial role in the Forex market, ensuring transparency, fairness, and stability. Regulatory bodies worldwide are continuously updating and enhancing regulations to address emerging challenges, such as market manipulation, cybersecurity risks, and investor protection. The future of the Forex market will likely see stricter regulations to safeguard market integrity and mitigate risks.

3. Globalization and Emerging Markets:

Globalization has led to increased cross-border trade and investment, which drives the demand for Forex transactions. Emerging markets, such as China, India, and Brazil, are experiencing rapid economic growth and are becoming significant players in the Forex market. As these markets continue to develop, their currencies may gain more prominence and influence in global Forex trading.

4. Shifts in Market Structure:

The Forex market’s structure may undergo changes in the future, driven by various factors:

a. Decentralization: The Forex market is decentralized, with trading taking place over-the-counter (OTC) rather than on a centralized exchange. However, technological advancements and the rise of blockchain technology have the potential to introduce decentralized trading platforms and digital currencies, which could impact the traditional Forex market structure.

b. Rise of Cryptocurrencies: Cryptocurrencies, such as Bitcoin and Ethereum, have gained considerable attention and popularity. While their impact on the Forex market is still evolving, the integration of cryptocurrencies into the financial system could introduce new trading opportunities and challenges.

c. Integration of Financial Markets: As financial markets become increasingly interconnected, trends and events in other markets, such as stocks, commodities, and bonds, can have a significant impact on currency movements. Traders need to consider these intermarket relationships and adapt their strategies accordingly.

5. Evolving Market Dynamics:

The Forex market is influenced by various economic, political, and social factors. Changes in global economic conditions, geopolitical events, monetary policies, and technological disruptions can all impact currency values. Traders must stay informed and adapt to evolving market dynamics to succeed in the Forex market.

It’s important to note that predicting the future of any financial market, including Forex, is challenging. However, by staying updated, embracing technological advancements, and adapting to changing market conditions, traders can position themselves for success in the evolving Forex market landscape.